Along with the Pajaro Valley, the area’s micro-climate keeps temperatures in the low 70s most of the season with moderate humidity and nighttime lows in the 50s. The growing season stretches from the early spring to the late fall, making the Monterey Bay area prime land for all sorts of agricultural products, including cannabis.

“(Producers) can harvest and ship from the end of March through Thanksgiving,” says Chuck Allen of KW Ag and Commercial Real Estate, who has 40 years of experience selling and leasing land in the region, which encompasses four-county Monterey Bay region.

It’s a hot real estate market for farming in general, but with the recent vote to approve recreational marijuana throughout the state, more and more people are turning their gaze toward the Salinas Valley with dreams of capitalizing on what many see as a possible “green rush” for farm land.

California is preparing for a building boom similar to what happened in Colorado, where Denver saw a 5 million-square-foot increase in just three years.

However, because growers must get permits from both the state and their local municipality, there is a patchwork of different laws and regulations, making some locations more inviting than others. Santa Cruz County, for example, taxes producers based on a percentage of gross sales, while Monterey County charges $15 per square foot per year.

“There are many people looking for cannabis properties — particularly in Monterey County,” Allen says, adding that Monterey allows for multiple cultivators on the same property.

On a Wednesday toward the end of 2016, for example, Allen says he had three conversations before 10 a.m. with potential cannabis growers and had multiple appointments and listings the day before.

“People keep coming,” he says.

Setting a Precedent

If the Colorado market is any indication, Allen is right to prepare for a jump.

Since legalization, Denver’s industrial real estate market has seen prices rise significantly, even as inventory continues to increase.

According to statistics from Jones Lang LaSalle, a financial and investment services firm that specializes in commercial real estate, the past two years have seen a more than $1 per square foot increase in rent in industrial areas.

JLL’s analysis of the Denver market shows the average industrial rent rose from $5.19 per square foot in the first quarter of 2014, right went the recreational market opened, to $7.62 in the fourth quarter of 2016.

In particular, warehouse rates rose at an even faster rate, going from $5.03 to $7.62 per square foot during the same time frame.

Meanwhile, the inventory in the Denver area continues to grow. According to JLL, the total inventory in early 2014 was just shy of 195 million square feet. By the end of last year, it had surpassed 200 million square feet, with an additional 1.7 million square feet under construction.

And with a population about seven times the size of Colorado and a real estate market already among the busiest and most expensive in the world, California is preparing for a boom of its own.

Salinas Valley

Demand currently outpaces supply in Allen’s area of the state as the continuous push for medical plots is joined by those looking to make their fortune on the recreational side of the business. However, because the adult-use regulations have not been finalized, Allen expects even more growers looking for land in the near future.

Allen says there is also a demand for greenhouses among his clientele because they allow producers to extend the growing season even further and harvest three or four crops a year. Regulations preventing open field production also help drive the greenhouse market.

According to Allen, the Monterey Bay area is packed with greenhouses due to the region being a major flower-growing area since the 1960s. However, while many of the properties are still in good shape and ready for use, many of the area’s younger residents seem to be moving to the cities, creating an aging population that will soon need to sell. He calls the cannabis industry a “godsend” to those families as new buyers look to get into farming.

Allen has also noticed an increase in buyers searching for warehouses suitable for indoor grow operations, since many cities have zoned their production facilities into industrial areas.

In the San Francisco area, Dana Wallace of 420Estates.net is selling both portable grow houses for industrial zones as well as farms complete with greenhouses. Photo courtesy of Dana Wallace.

Bay Area

Meanwhile, just up Highway 101, the San Francisco Bay area’s notoriously hot real estate market also extends to cannabis properties, according to Dana Wallace of 420Estates.net, a real estate and consulting firm specifically aligned with the marijuana industry.

Wallace, who received her license as a real estate agent in 2002, transitioned her business to focus on cannabis in mid-2016. While business was booming prior to the November election, things have picked up even more since then.

Wallace says the Bay Area market includes land for greenhouses and outdoor facilities, along with retail space and commercial manufacturing facilities. But on the production side, most of the focus is on warehouse space for grow operations.

Wallace spends a lot of her time talking with potential clients and then looking for property that will meet their needs. She echoes Allen’s remarks about the various county and city laws currently being considered, including the moratoriums in place in many areas as municipalities take a heavy-handed approach toward regulations.

“It’s great, but it is also still evolving,” she says of the industry.

Following the 2016 vote, investors began snatching up properties, causing prices around the region to jump, she says.

“It’s huge,” she says of land costs. “And people are paying it.”

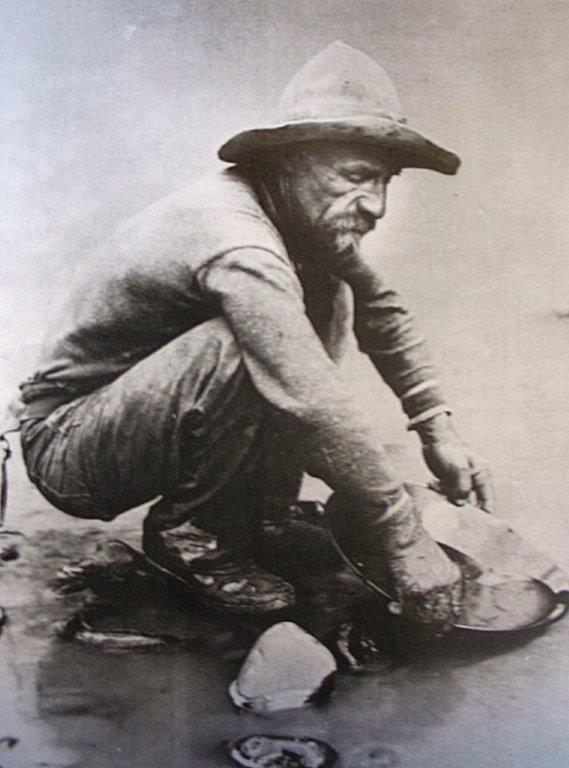

Prospectors once flocked to California with the hopes of striking it rich in gold. With the legalization of recreational marijuana, a second rush of prospectors is expected in the Golden State next year.

SoCal

At the southern end of the state in San Diego, real estate lawyer Sasan Mirkarimi, president of Equity Legal, LLP, says there was a lot of activity in the fall, especially in the industrial zones around his city as manufacturers and cultivators get ready to go recreational.

“It’s buzzing,” he says. “It’s been crazy.”

In San Diego County, the push is for industrial, commercial and warehouse space. Mirkarimi says greenhouse properties are still ideal, but those are more expensive and outside the city, making them more attractive to bigger players who will likely be ramping up operations in the next year.

“Right now we’re seeing a lot of focus on industrialized areas,” he says.

With licensing laws expected to go into effect early this year, Mirkarimi says he too has seen an uptick in business since the November vote.

“We’re diving right in,” he says. “One passage of one law has changed the ship considerably.”

In his area in particular, many properties are not even listed, so brokers have to use unconventional ways of finding properties for clients.

And while additional zoning regulations could change the market within the next year, Mirkarimi tells his clients that even in the worst-case scenario, it’s still California real estate, and that will only increase in value.

But like Wallace in San Francisco, Mirkarimi is dedicated to helping his clients negotiate the web of municipal and county laws. As a real estate attorney who works as a broker, he says his firm is well suited to helping buyers get the space they need, while navigating the regulatory landscape, which could hinder some investors.

The construction boom expected to follow the legalization has garnered the cannabis industry support from numerous ancillary industries. Photo courtesy of OutCo.

2017

While the state has approved recreational marijuana, the majority of city and county laws are not yet in place, which causes many buyers to wait on the sidelines for now. However, almost everyone expects the market to explode things to blow up as moratoriums are lifted and more cities begin licensing.

“This year, 2017, is going to be a very active year,” predicts Allen, who says he’s not worried about oversaturation in his market because the demand from retailers still outpaces the amount being produced by farmers.

“There’s a big appetite,” agrees Mirkarimi, who sees the era of “crazy risk” giving way to an era of “calculated risk” that will lead to bigger players looking to get their money into the biggest market in the world.

“They’re really coming in with money,” he says of investors from around the country. “I think this is the year there’s that separation.”

Questions remain regarding how the Trump administration will handle the cannabis industry, as well as how individual communities might deal with it, but overall, Mirkarimi does not expect too many serious roadblocks in the way.

Neither does Wallace. She sees her Bay area market and the Southern California market already getting saturated and prices beginning to rise as demand for production space gets even higher.

“I think 2017 is going to be prime for the market as these different areas open up,” she says. “There’s endless opportunity right now.”

[contextly_auto_sidebar]